IRS Free File Program: IRS Should Develop Additional Options for Taxpayers to File for Free

Fast Facts

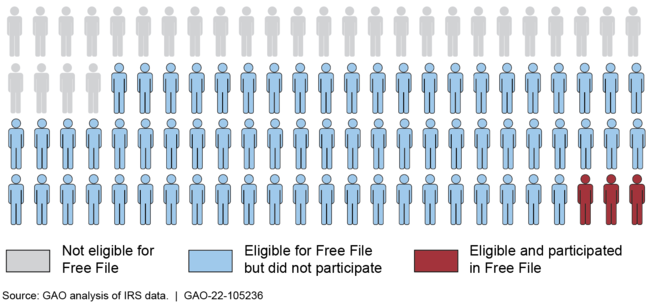

IRS and a consortium of tax preparation companies offer free online tax preparation services and filing help under the Free File program. About 70% of taxpayers could use it, but less than 3% of taxpayers do.

IRS wants to improve Free File, including enhancing access for taxpayers with disabilities. But improving Free File may increase requirements on tax preparation companies, leading them to opt out. Stakeholders had differing views on whether IRS should keep Free File after its 2023 agreement expires or develop its own online filing system.

Our recommendations address these and other issues we found.

Highlights

What GAO Found

Taxpayers whose incomes are below a certain threshold can use the Free File program provided by IRS and Free File, Inc. (FFI), a consortium of tax preparation companies, to electronically prepare and file their federal tax returns for free. GAO found that the vast majority of taxpayers eligible for the program used other filing methods, which they may have paid to use. Of those who did use the program, 44 percent had an adjusted gross income of $17,000 or less.

Individual Taxpayers' Filing Methods for Tax Year 2020

IRS and FFI have an agreement that governs the program, including provisions intended to improve the taxpayer experience. IRS checks the companies' compliance with this and certain other provisions. GAO compared the current Free File agreement with federal guidelines for digital services and found differences. Through negotiation between IRS and FFI, opportunities may exist to better align the current agreement with the federal guidelines, such as ensuring access for taxpayers with disabilities.

IRS and FFI recently extended the current agreement to October 2023; however, short-term extensions have not addressed mounting challenges. For example, two large companies recently left the program with one citing the taxpayer experience requirements. IRS data through most of the 2022 filing season shows that fewer taxpayers are using the program in the year following the departure of one of these companies last year. Stakeholders had different views on whether maintaining the current program or IRS developing its own online filing system would provide a better experience for taxpayers. Regardless, IRS is not managing the risk of relying on the Free File program as the way it helps taxpayers file for free online. Under the terms of the agreement, individual companies can leave the Free File program at any time, and FFI can end the program if IRS develops a system of its own. By not managing these risks through the development of additional free online filing options for taxpayers, IRS may be unable to achieve its strategic goal to empower all taxpayers to meet their tax obligations.

Why GAO Did This Study

IRS and FFI offer free tax filing services to a large majority of taxpayers. Historically, IRS had agreed that it would not develop its own online filing services in exchange for the participating companies offering free services to eligible taxpayers.

GAO was asked to examine the Free File program. This report (1) describes demographic characteristics of Free File users; (2) evaluates IRS's oversight of taxpayer experience provisions; and (3) identifies key challenges and alternative approaches that may exist for IRS to help taxpayers file online at no cost.

GAO analyzed IRS data; evaluated IRS's oversight of agreements with FFI and compared these to federal digital service guidelines; reviewed IRS documents and studies; and used interviews with selected authors of studies (called stakeholders) and IRS officials to inform the analysis.

Recommendations

GAO is making three recommendations to IRS, including that it add relevant practices from federal guidelines into its next agreement with FFI, and that it identify and develop additional options for free online filing by the time the current Free File agreement expires. IRS agreed with the recommendation to add relevant practices to improve the taxpayer experience into the next FFI agreement. IRS did not agree with the other recommendations, including that it develop additional free filing options. GAO maintains that developing such options would help mitigate risks identified with the Free File program.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status Sort descending |

|---|---|---|

| Internal Revenue Service | The Commissioner of IRS should seek agreement with FFI on incorporating recommended taxpayer experience improvements and relevant practices from guidelines for federal digital services, such as the 21st Century Integrated Digital Experience Act requirements regarding access for users with disabilities. (Recommendation 1) |

IRS agreed with this recommendation and has taken some steps to improve mobile phone optimization and improving access for taxpayers with disabilities, which were two of the differences GAO identified between the agreement with Free File, Inc. (FFI) and guidelines for federal digital services. IRS and FFI signed an updated 9th memorandum of understanding (MOU) in 2023 which added a provision to assist taxpayers who are visually impaired by providing an audio option for a CAPTCHA security check. In addition, IRS officials began reviewing the mobile experience of each participating company's Free File service in fiscal year 2023. The initial review found that companies provided a good mobile experience, and IRS stated it will continue to review the mobile experience annually. However, the MOU does not require participating companies to follow recent guidance from the Office of Management and Budget (OMB Memorandum 23-22) that mobile-first design should be used for federal digital services, which presents risks as technology continues to evolve. Additionally, OMB states that digital services should be offered in languages that meet the needs of customers. While IRS officials report working with FFI officials to develop a Free File product in Spanish, free federal returns in Spanish are only available to taxpayers in 29 states and there are no free state returns in Spanish. Further, the MOU does not require Free File services to be provided in other languages. We will continue to monitor IRS's efforts to fully address our recommendation.

|

| Internal Revenue Service | The Commissioner of IRS should seek agreement with FFI on eliminating the MOU provision requiring IRS to notify FFI immediately if it commits funding to offer services for free to taxpayers. (Recommendation 2) |

IRS disagreed with this recommendation. In October 2022, IRS's Deputy Commissioner for Services and Enforcement reiterated IRS's position. The IRS official stated that it continues to believe this provision is necessary to maintain trust and transparency with Free File, Incorporated (FFI). In 2023, IRS and FFI agreed to extend their agreement through October 2025 and did not remove this provision. We understand IRS's concerns about maintaining trust in the program and our report recognizes IRS's efforts to communicate and coordinate with FFI. We continue to believe that IRS should work to eliminate this provision so that IRS can freely pursue new filing options for taxpayers as resources and technology permit. Eliminating the provision would in no way prohibit IRS from choosing to discuss its plans with FFI to maintain transparency and trust. In August 2022, Congress provided IRS with $15 million in the Inflation Reduction Act to study the possibility of an IRS-run system. In May 2023, IRS issued its report to Congress on the potential for a free direct file system and the Deputy Secretary of the Treasury directed IRS to pilot a Direct File system during the 2024 tax filing season. IRS piloted a Direct File system between January and April 2024 which was available for taxpayers with simple tax situations residing in certain states. We believe that as part of this process IRS should consider the extent to which this provision could make it more difficult to transition to a new system if Congress decides on such a course of action. We will continue to monitor IRS's efforts to address this recommendation.

|

| Internal Revenue Service |

Priority Rec.

The Commissioner of IRS should, before the expiration of the current Free File MOU in October 2023, work with relevant stakeholders to identify and develop additional options for free online filing of tax returns that would reflect current guidelines for federal digital services. (Recommendation 3) |

IRS originally disagreed with this recommendation. In its April 2022 comments on the report, IRS stated that it did not believe a public free filing option would significantly improve the taxpayer experience and it did not have sufficient funding to do this. In June 2022, our recommendation was discussed at a hearing of the Senate Committee on Finance during which the Secretary of the Treasury stated that IRS was looking into the possibility of a government run online filing system. In August 2022, Congress provided IRS with $15 million in the Inflation Reduction Act to study the possibility of an IRS-run system. In May 2023, IRS issued its report to Congress on the potential for a free direct file system and the Deputy Secretary of the Treasury directed IRS to pilot a Direct File system during the 2024 tax filing season. IRS piloted a Direct File system between January and April 2024 which was available for taxpayers with simple tax situations residing in certain states. IRS stated that the agency intended for the Direct File pilot to provide an additional option for some taxpayers and officials focused on how to improve the taxpayer experience through Direct File. IRS directed taxpayers not eligible for the Direct File pilot to other filing options, including the Free File program. IRS and Free File, Inc. extended the current Free File Memorandum of Understanding until October 2025.

|